free crypto tax calculator australia

Simple fast reports Accurate and complex calculations Affordable plans FREE TRIAL Free trial 0. Well go through the easiest and most accurate technique first.

Top 10 Crypto Tax Return Software For Australia Crypto News Au

Create your free account now.

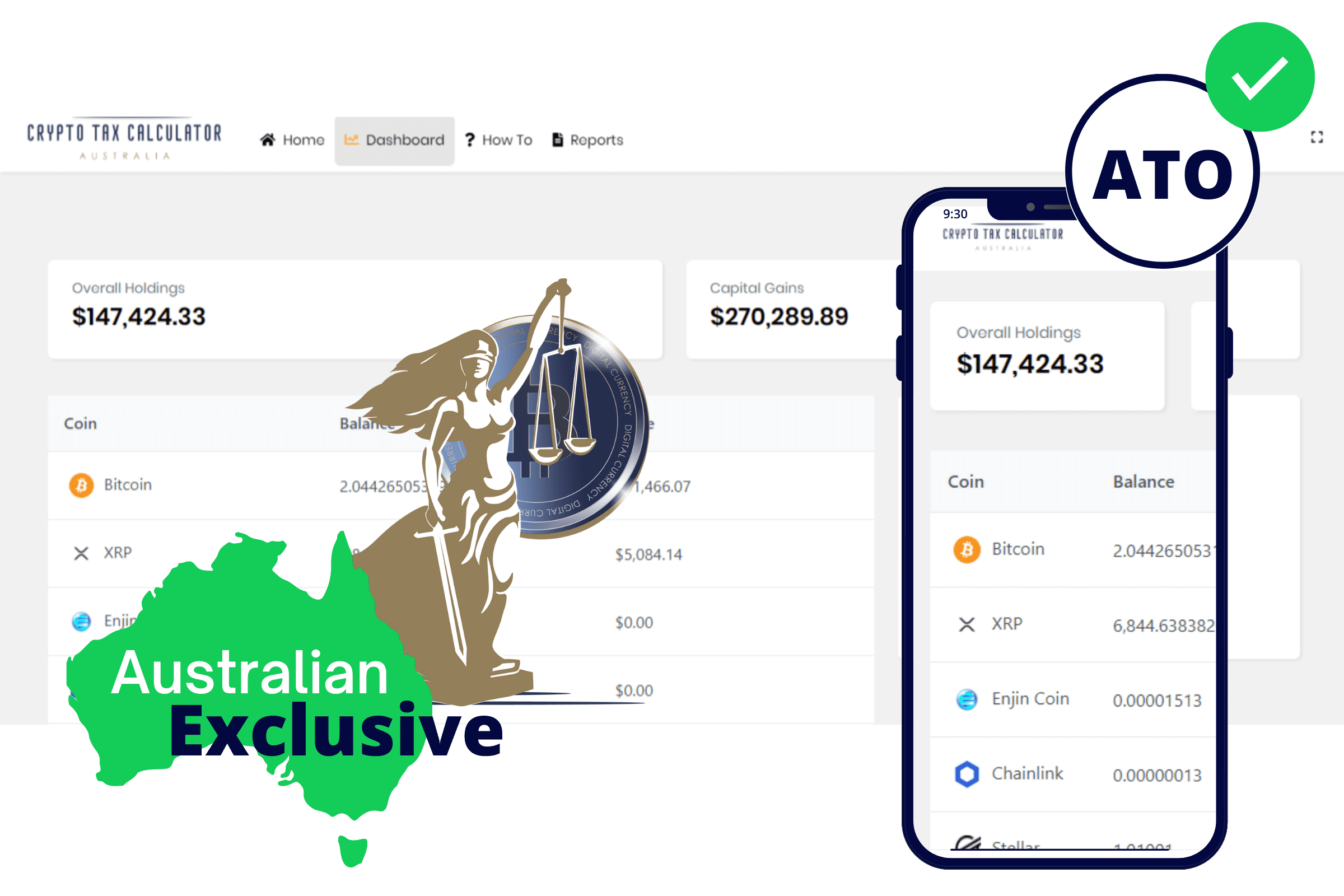

. CryptoTax Calculator is another great option for Australians who want to automate their crypto tax reporting. At the top right click on the drop down menu on your account information and select Order History. TokenTax works as a cryptocurrency tax calculator that connects to every crypto exchange.

Although the popular exchange and payment platform didnt reveal which jurisdiction is next they will likely focus on where the majority of. As part of that commitment we are proud to offer all Australian crypto investors an easy solution to filing their taxes. Check out our free and comprehensive guide to crypto taxes in Australia.

We have long been committed to offering the most compliant and easy to use crypto platform in the world. It flawlessly tracks all of your wallet transactions like capital gains capital losses and exchanges. Were excited to expand our free-to-use crypto tax reporting service to Australia.

We support hundreds of exchanges blockchains and wallets. Send the report to your accountant to complete your taxes. However keep in mind that you only have to pay.

In most cases yes you will have to pay tax on any crypto profits you make in Australia. Get started JOIN COINPANDA Sign up for free Calculate your taxes in under 20 minutes. It takes less than a minute to sign up.

Simply import your cryptocurrency data in form of a CSV file and calculate the capital gain taxes in Australia instantly. Above your trades is a button that says BuysSells CSV. Login to your Coinspot account.

More markets will be added soon. There are no limitations on the data source and you can import data from anywhere. Youll only start to pay Income Tax when you hit 18200 in total income per year.

It offers a free trial that allows you to import data review transactions see a full. On the 3 - Personalise return page make the following selection in addition to your regular income to ensure that your tax return reflects your crypto activity. You can use our crypto profitloss calculator to work out how much profit or loss you made.

Create a report on crypto activity using a crypto tax calculator like Crypto Tax Calculator Australia. Our Australian crypto tax calculator is the perfect tool for anyone to calculate their crypto tax. Ensure your Contact details and Financial institution details are correct and head to step 3 - Personalise return page.

Click Prepare for your 2021-22 Individual income tax. That way you can use our crypto tax calculator application today. 1 Add data from hundreds of sources Directly upload your transaction history via CSV or API integrations.

Tax situations vary between individuals the estimate provided by the cryptocurrency tax calculator is based solely on the input you enter. 2 We help you categorize transactions Been trading on a DEX. Simply copy the numbers into your annual tax return.

Rookie A 49 billed yearly Get started For users who dabble in the crypto space. Here are four strategies to successfully complete your crypto taxes. Crypto Tax Calculator Plans Pricing All plans include coverage for every type of crypto transaction including but not limited to DeFi DEXs derivatives and staking as well as downloadable reports for all financial years under a single 365-day subscription.

CryptoTaxCalculator helps ease the pain of preparing your crypto taxes in a few easy steps. Canada was its first supported jurisdiction followed by the United States and now Australia with plans to expand to other markets. The CSV file will be saved to your device.

It supports all major exchanges and wallets and offers a range of features to help you stay compliant with the ATO. Crypto tax breaks Australian tax residents get a little breathing space with a number of tax-free thresholds and allowances that happily apply to crypto too. Crypto tax guide Mining staking income Generate complete tax reports for mining staking airdrops forks and other forms of income.

ETH 1389190 KFI 1289190 AFX 989190 17 transactions 6334 remaining ETH 88188 BTC 3216 KFI 2716 ETH 51288 KFI 4516 46 transactions 4334 remaining img section. Click on this to download your CSV file. Crypto Tax Calculators annual subscription ranges from 49 to 399 and supports up to 100000 transactions.

CryptoTax also has a free plan for those with a small number of transactions and also covers DeFi NFT and DEX trading.

Crypto Tax Calculator Australia Calculate Your Crypto Tax

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

What You Need To Know About The Binance Tax Reporting Tool Binance Blog

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Best Crypto Tax Software Top Solutions For 2022

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Top 10 Crypto Tax Return Software For Australia Crypto News Au

Coinledger Australia S 1 Crypto Tax Software

Coinpanda Free Bitcoin Crypto Tax Software

Best Crypto Tax Software Top Solutions For 2022

Crypto Com Now Offers Free Crypto Tax Calculator In Germany Financefeeds

Crypto Tax Free Countries 2022 Koinly

Free Crypto Tax Calculators 2022 Calculate Your Bitcoin Taxes For Free

Top 10 Crypto Tax Return Software For Australia Crypto News Au

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

![]()

Top 10 Crypto Tax Return Software For Australia Crypto News Au