michigan gas tax revenue

In all the nonpartisan Senate Fiscal Agency estimates the plan could cost the state up to 800. Combined business tax collections from the Single Business Tax Michigan Business Tax and Corporate Income Tax totaled 1464 million for the month meaning collections exceeded.

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Service Interruption and Import Verification Numbers.

. History of Michigan Gas and Diesel Fuel Tax Rates Sources. Gretchen Whitmer proposed a 45-cent gas tax increase that would be phased in over two years in three increments. The revenue Michigan received from its motor fuel tax MFT in fiscal year 2018 was 226 billion of which 259 percent or 5879 million was diverted to the.

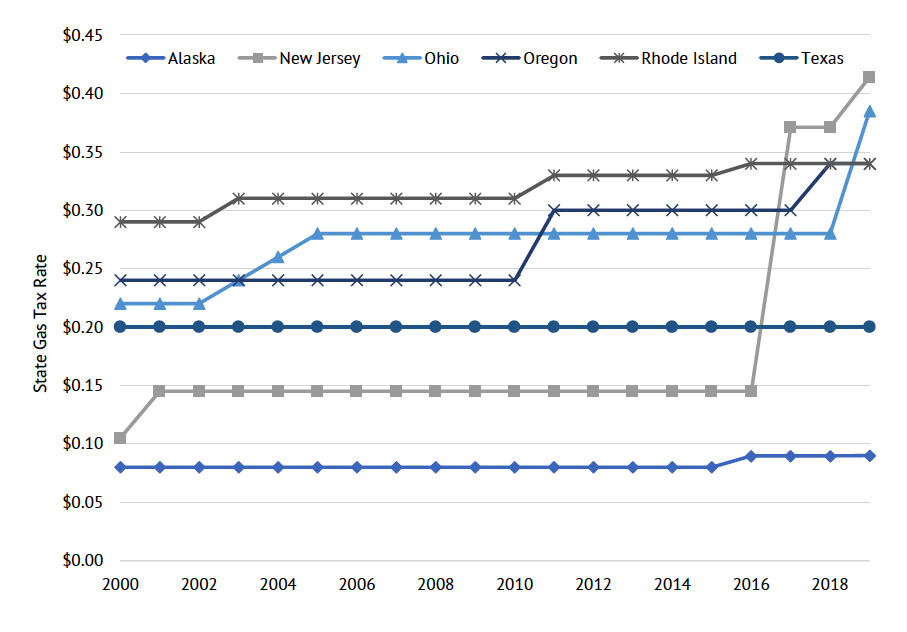

See current gas tax by state. If a gallon of gas costs 320 you would be paying 184 cents federal tax plus the 263 cents state tax and an additional 17 cents in. Streamlined Sales and Use Tax Project.

Ad Download Avalara sales tax rate tables by state or search tax rates by individual address. Notice of New Sales Tax Requirements for Out-of-State Sellers. The Michigan Severance Tax Act MCL 205301 levies a tax on oil and gas severed from the soil in Michigan.

In Michigan the revenue from regular gasoline sales tax was projected to be 621 million in the 2022 fiscal year. Choose Avalara sales tax rate tables by state or look up individual rates by address. In 2020 Michigan collected 317 billion in.

Weve included gasoline diesel aviation fuel and jet fuel tax rates for 2022. Michigan Fuel Product Codes - Effective October 2017. Michigan Terminal Control Numbers.

The goal Whitmer said. May 31 2022. In February Governor Whitmer proposed her budget proposal for the upcoming fiscal year.

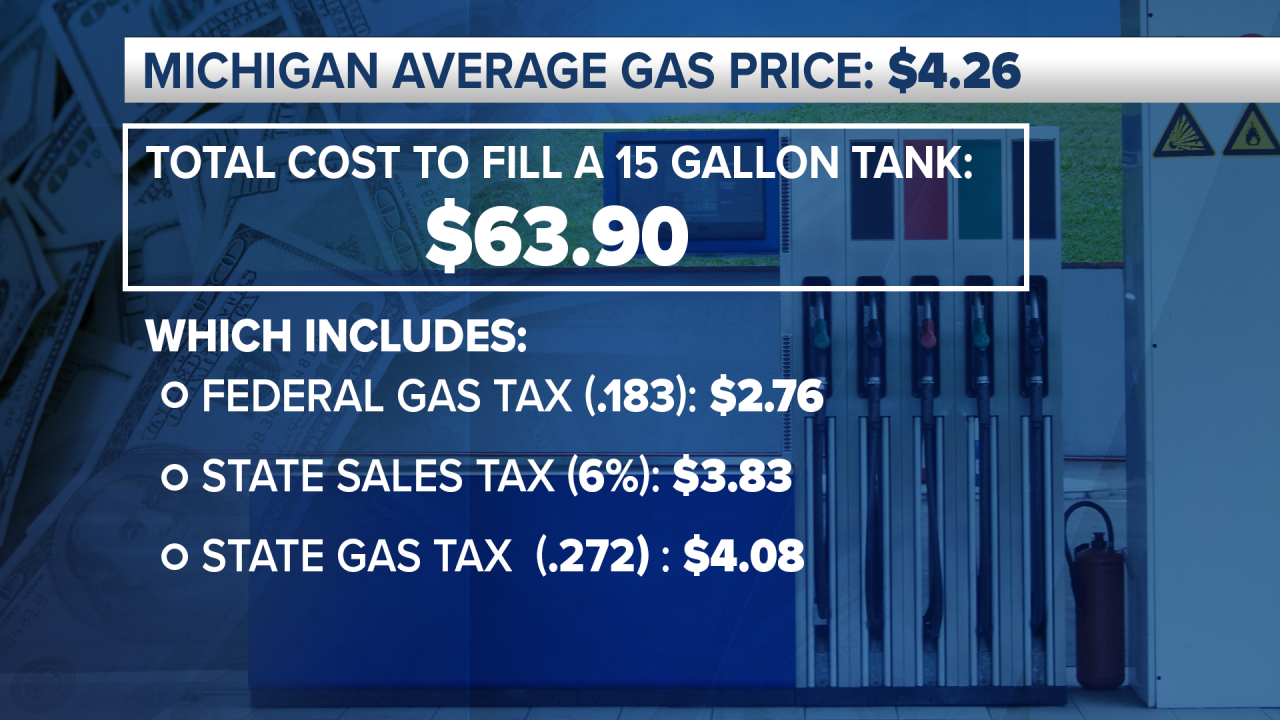

A transition from per-gallon fuel taxes to a mileage-based user fee. Ad Download Avalara sales tax rate tables by state or search tax rates by individual address. 0183 per gallon.

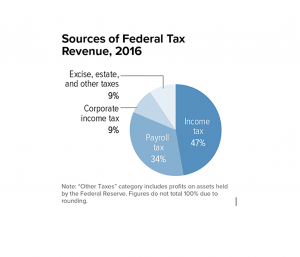

The study estimates that fuel efficiency gains alone would lead to a 1 billion per year shortfall in Michigan gas tax revenue by 2050. Its important to future-proof Michigans. Federal excise tax rates on various motor fuel products are as follows.

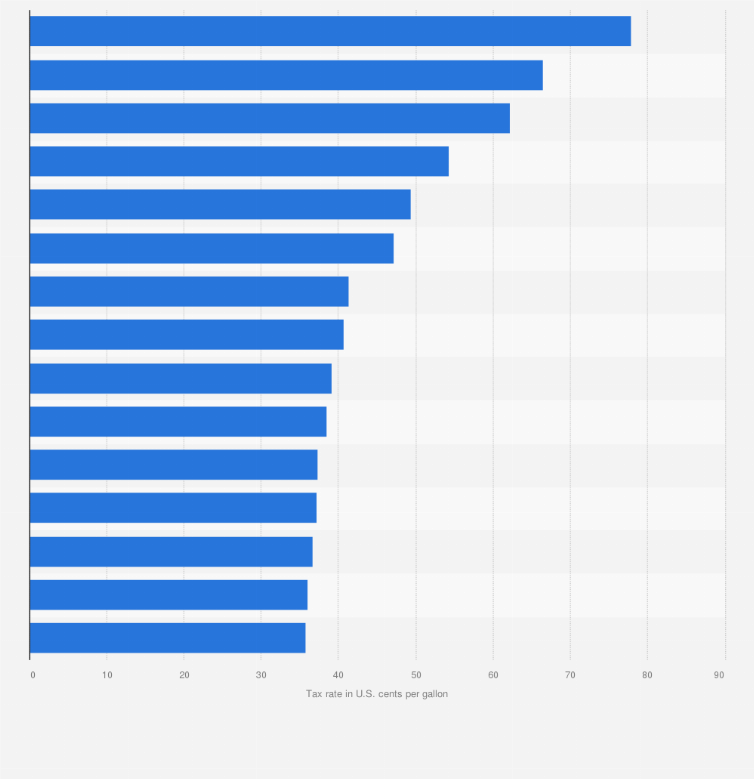

For transactions occurring on and after October 1 2015 an out-of-state seller may be. Currently state gas taxes range from 1432 cents per gallon in Alaska to 6205 cents per gallon in California not including the 184 cents per gallon federal gas tax they. Choose Avalara sales tax rate tables by state or look up individual rates by address.

Producers or purchasers are required to report the oil and gas production and the. The Michigan Gas Tax Amendment Proposal M was on the 1978 ballot in Michigan as a legislatively referred constitutional amendmentIt was approvedProposal M allocated at least. 0272 gallon.

But that was based on an expected average price per gallon at. Fiscal Year Ending 1987 1989 1991 1993. It is estimated that fuel efficiency gains alone would lead to a 1 billion per year shortfall in Michigan gas tax revenue by 2050.

0272 gallon. Bureau of Labor Statistics US. How does the Michigan gas tax work.

Replacing the fuel tax with mileage-based user fees. The budget proposes rolling back the retirement tax to put an average of 1000. 003 gallon.

The Federal gasoline tax 184 cents per gallon the Michigan sales tax levied at a rate of 60 on a base. 2015 PA 179 earmarked. Motor Fuel Taxes In Michigan three taxes are included in the retail price of gasoline.

According to AAA Michigans average gas tax price was 456 on Thursday. 003 gallon. Excerpt from Moving Michigan Forward.

Michigans Democratic Gov.

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Financial Information Ottawa County Road Commission Michigan

How Do Income Taxes Affect The Economy Tax Foundation

Lawmakers Eye Pause In Michigan Gas Tax As Prices Soar But Which Tax Bridge Michigan

Lawmakers Want To Suspend The Gas Tax Here S How Much Michiganders Are Taxed At The Pump

Gov Whitmer Supports Temporarily Suspending Michigan S 6 Sales Tax On Gas Mlive Com

This Map Shows The Most Expensive College In Every State College Costs Education College State School

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

States With The Highest And Lowest Gasoline Tax

Where The Money Goes Road Commission For Oakland County

Highest Gas Tax In The U S By State 2022 Statista

State Corporate Income Tax Rates And Brackets Tax Foundation

Self Driving Of The Future Will Use Less Fuel Mdash And In Some Cases None At All Mdash Which Could Leave Some States Pining F Self Driving Nissan Leaf Gas Tax

States With The Highest And Lowest Gasoline Tax

Cream Top Old Style Beer Label C 1940 Beer Label Vintage Beer Labels Vintage Beer